Understanding the Effects of the September 2025 Interest Rate Cut on Your Finances

August 23, 2025 - 18:13

As the anticipated interest rate cut approaches in September 2025, many are left wondering how this change will affect their personal finances. This adjustment is expected to have significant implications for various aspects of economic life, including borrowing costs, savings yields, the housing market, and investment strategies.

With lower interest rates, borrowing costs are likely to decrease, making loans more affordable for consumers. This could lead to increased spending on big-ticket items such as cars and homes, stimulating economic growth. However, the flip side is that savings yields may also drop, meaning that those relying on interest from savings accounts could see diminished returns.

In the housing market, a rate cut may encourage more buyers to enter the market, potentially driving up home prices due to increased demand. Investors may also need to reassess their portfolios, as lower rates can affect stock market performance and bond yields.

Overall, the September 2025 interest rate cut presents both opportunities and challenges for individuals and families as they navigate their financial futures.

MORE NEWS

March 3, 2026 - 11:42

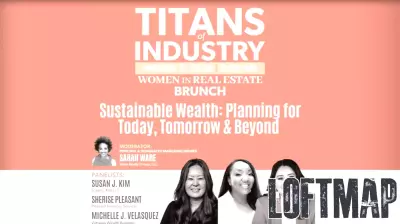

Women in Real Estate Brunch this week in ChicagoThe Windy City is set to welcome a significant gathering of professionals this week with the inaugural Women in Real Estate Brunch. The event, designed to foster connection and collaboration, will...

March 2, 2026 - 20:37

Lawmakers to make real estate wholesalers disclose business modelsA new legislative effort is taking direct aim at the practices of real estate wholesalers, mandating greater transparency in their business models. The proposed law seeks to protect vulnerable...

March 2, 2026 - 00:12

Real Estate Agent Reveals Overlooked Thing That Turn Buyers off Your HomeA seasoned real estate professional has highlighted a surprisingly common yet frequently missed flaw that can derail a home sale. According to the agent, this particular issue is something sellers...

March 1, 2026 - 03:28

Hey, real estate brokers: AI is not ‘coming soon,’ it’s already hereThe commercial real estate industry is no longer waiting on the horizon for artificial intelligence; it is actively operating in the here and now. From automating property valuations and generating...