Real Estate Stocks Decline as Government Shutdown Persists and Trade War Fears Resurface

October 11, 2025 - 19:59

Real estate stocks ended the week in the red, paralleling the downward trends seen in major market averages. The ongoing government shutdown has continued to create uncertainty in the financial markets, contributing to the decline in investor confidence. This instability is compounded by renewed concerns regarding trade relations, particularly with tariffs that could impact various sectors, including real estate.

As investors grapple with these challenges, many are reevaluating their portfolios, leading to increased volatility in real estate stocks. The combination of a protracted government shutdown and the potential for escalating trade tensions has left many market participants cautious. Analysts suggest that until there is clarity on both the government’s fiscal policies and international trade agreements, the real estate sector may continue to face headwinds.

Market watchers are closely monitoring developments, as any resolution to these issues could significantly influence the trajectory of real estate stocks in the near future.

MORE NEWS

March 3, 2026 - 11:42

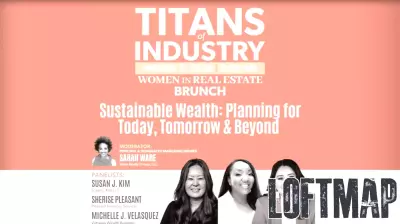

Women in Real Estate Brunch this week in ChicagoThe Windy City is set to welcome a significant gathering of professionals this week with the inaugural Women in Real Estate Brunch. The event, designed to foster connection and collaboration, will...

March 2, 2026 - 20:37

Lawmakers to make real estate wholesalers disclose business modelsA new legislative effort is taking direct aim at the practices of real estate wholesalers, mandating greater transparency in their business models. The proposed law seeks to protect vulnerable...

March 2, 2026 - 00:12

Real Estate Agent Reveals Overlooked Thing That Turn Buyers off Your HomeA seasoned real estate professional has highlighted a surprisingly common yet frequently missed flaw that can derail a home sale. According to the agent, this particular issue is something sellers...

March 1, 2026 - 03:28

Hey, real estate brokers: AI is not ‘coming soon,’ it’s already hereThe commercial real estate industry is no longer waiting on the horizon for artificial intelligence; it is actively operating in the here and now. From automating property valuations and generating...