Real Estate Stocks Climb During Thanksgiving Week Amid Rising Rate Cut Expectations

November 30, 2025 - 02:34

Real estate stocks experienced a notable increase during Thanksgiving week, driven by growing expectations of a potential interest rate cut by the Federal Reserve in December. Investors reacted positively to economic indicators suggesting a slowdown in inflation, which has led to speculation that the Fed may ease monetary policy in the near future.

This optimism surrounding rate cuts has bolstered confidence in the real estate sector, as lower interest rates typically enhance affordability for homebuyers and reduce borrowing costs for developers. Consequently, many real estate investment trusts (REITs) and related stocks have seen significant gains, reflecting the market's anticipation of a more favorable borrowing environment.

As the holiday season approaches, analysts are closely monitoring economic data and Fed communications for signs that could impact future monetary policy decisions. The potential for lower rates could further invigorate the real estate market, making it a focal point for investors looking for opportunities in a changing economic landscape.

MORE NEWS

March 3, 2026 - 11:42

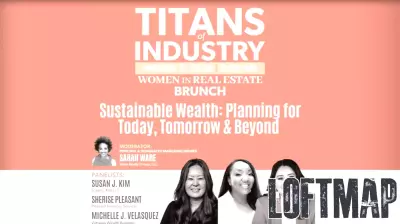

Women in Real Estate Brunch this week in ChicagoThe Windy City is set to welcome a significant gathering of professionals this week with the inaugural Women in Real Estate Brunch. The event, designed to foster connection and collaboration, will...

March 2, 2026 - 20:37

Lawmakers to make real estate wholesalers disclose business modelsA new legislative effort is taking direct aim at the practices of real estate wholesalers, mandating greater transparency in their business models. The proposed law seeks to protect vulnerable...

March 2, 2026 - 00:12

Real Estate Agent Reveals Overlooked Thing That Turn Buyers off Your HomeA seasoned real estate professional has highlighted a surprisingly common yet frequently missed flaw that can derail a home sale. According to the agent, this particular issue is something sellers...

March 1, 2026 - 03:28

Hey, real estate brokers: AI is not ‘coming soon,’ it’s already hereThe commercial real estate industry is no longer waiting on the horizon for artificial intelligence; it is actively operating in the here and now. From automating property valuations and generating...