Neinor's Bold Move: A €1.07 Billion Acquisition of AEDAS

June 16, 2025 - 23:16

Neinor has made headlines with its recent announcement of a €1.07 billion tender offer for AEDAS, a strategic maneuver that promises to reshape the residential real estate market. The acquisition involves Castlelake, which holds a 79% stake in AEDAS, agreeing to sell its shares at €24.485 each, translating to €21.335 post-dividend.

This deal includes the procurement of a premium portfolio valued at approximately €2 billion, comprising around 20,200 residential units. Notably, the acquisition is being executed at a roughly 30% discount to the net asset value (NAV), highlighting a strategic opportunity for Neinor.

The company's conservative underwriting approach targets an impressive internal rate of return (IRR) of over 20% and a multiple on invested capital (MOIC) of 1.8x. This transaction is expected to significantly de-risk Neinor's operations while accelerating its Strategic Plan for 2023-2027. Analysts predict a substantial earnings uplift of €150 million over the next few years, representing a 40% increase compared to the initial targets outlined in the Strategic Plan.

MORE NEWS

March 3, 2026 - 11:42

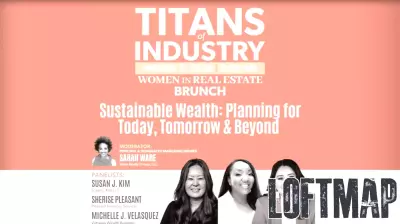

Women in Real Estate Brunch this week in ChicagoThe Windy City is set to welcome a significant gathering of professionals this week with the inaugural Women in Real Estate Brunch. The event, designed to foster connection and collaboration, will...

March 2, 2026 - 20:37

Lawmakers to make real estate wholesalers disclose business modelsA new legislative effort is taking direct aim at the practices of real estate wholesalers, mandating greater transparency in their business models. The proposed law seeks to protect vulnerable...

March 2, 2026 - 00:12

Real Estate Agent Reveals Overlooked Thing That Turn Buyers off Your HomeA seasoned real estate professional has highlighted a surprisingly common yet frequently missed flaw that can derail a home sale. According to the agent, this particular issue is something sellers...

March 1, 2026 - 03:28

Hey, real estate brokers: AI is not ‘coming soon,’ it’s already hereThe commercial real estate industry is no longer waiting on the horizon for artificial intelligence; it is actively operating in the here and now. From automating property valuations and generating...