Gayle Benson Expands Real Estate Portfolio with Major Office Tower Acquisition in New Orleans

June 17, 2025 - 12:52

Saints and Pelicans owner Gayle Benson has made a significant investment in New Orleans by purchasing one of the largest office towers in downtown. This acquisition comes at a time when the market is experiencing a downturn, reflecting Benson's belief in the city's potential for recovery.

Benson expressed her confidence in the future of downtown New Orleans, particularly highlighting the ongoing development of the BioDistrict. She emphasized that projects like the renovation of Charity Hospital are poised to enhance economic activity in the area. This strategic move not only demonstrates her commitment to the city but also her vision for revitalizing its urban landscape.

As the city navigates through economic challenges, Benson's investment signals a vote of confidence in New Orleans' future, potentially paving the way for further developments that could transform the downtown area and stimulate growth in the local economy.

MORE NEWS

March 3, 2026 - 11:42

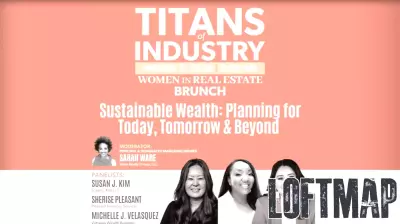

Women in Real Estate Brunch this week in ChicagoThe Windy City is set to welcome a significant gathering of professionals this week with the inaugural Women in Real Estate Brunch. The event, designed to foster connection and collaboration, will...

March 2, 2026 - 20:37

Lawmakers to make real estate wholesalers disclose business modelsA new legislative effort is taking direct aim at the practices of real estate wholesalers, mandating greater transparency in their business models. The proposed law seeks to protect vulnerable...

March 2, 2026 - 00:12

Real Estate Agent Reveals Overlooked Thing That Turn Buyers off Your HomeA seasoned real estate professional has highlighted a surprisingly common yet frequently missed flaw that can derail a home sale. According to the agent, this particular issue is something sellers...

March 1, 2026 - 03:28

Hey, real estate brokers: AI is not ‘coming soon,’ it’s already hereThe commercial real estate industry is no longer waiting on the horizon for artificial intelligence; it is actively operating in the here and now. From automating property valuations and generating...