eXp World Holdings (EXPI): Assessing Its Current Market Value

October 4, 2025 - 22:40

eXp World Holdings (EXPI) has experienced notable fluctuations in its stock price recently, raising questions about its true market value. Despite a recent uptick, the company's stock has been on a rollercoaster ride over the past year, with a significant decline in its total shareholder return, which is down nearly 19 percent. This downturn has left investors curious about the underlying factors affecting the company's valuation.

The volatility in eXp's stock price reflects broader trends in the real estate technology sector, where market dynamics can shift rapidly due to economic conditions and investor sentiment. Analysts are closely monitoring the company's performance indicators, including revenue growth, market expansion, and operational efficiency, to gauge its potential for recovery.

As eXp World Holdings navigates these challenges, stakeholders are keen to identify signals that could indicate a turnaround, making the coming months critical for the company's trajectory in the competitive real estate landscape.

MORE NEWS

March 3, 2026 - 11:42

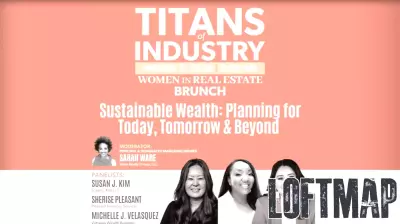

Women in Real Estate Brunch this week in ChicagoThe Windy City is set to welcome a significant gathering of professionals this week with the inaugural Women in Real Estate Brunch. The event, designed to foster connection and collaboration, will...

March 2, 2026 - 20:37

Lawmakers to make real estate wholesalers disclose business modelsA new legislative effort is taking direct aim at the practices of real estate wholesalers, mandating greater transparency in their business models. The proposed law seeks to protect vulnerable...

March 2, 2026 - 00:12

Real Estate Agent Reveals Overlooked Thing That Turn Buyers off Your HomeA seasoned real estate professional has highlighted a surprisingly common yet frequently missed flaw that can derail a home sale. According to the agent, this particular issue is something sellers...

March 1, 2026 - 03:28

Hey, real estate brokers: AI is not ‘coming soon,’ it’s already hereThe commercial real estate industry is no longer waiting on the horizon for artificial intelligence; it is actively operating in the here and now. From automating property valuations and generating...