RIST Sets Ambitious Real Estate Goals for 2025

January 31, 2025 - 12:05

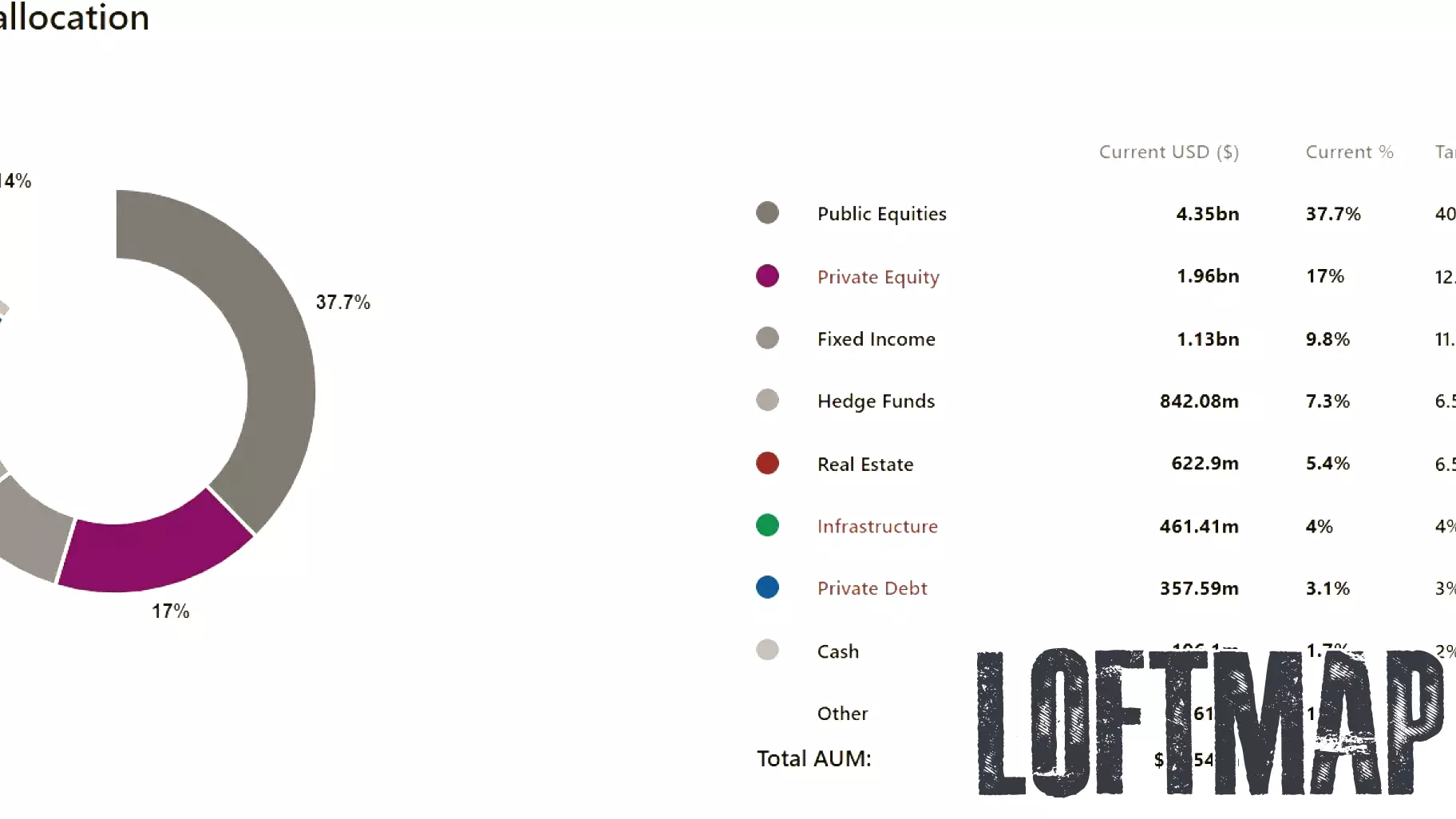

In a strategic move to enhance its investment portfolio, RIST has unveiled its real estate targets for the year 2025. The US-based pension fund is focusing on addressing its underweight positions in the multi-family and retail sectors, aiming to capitalize on growth opportunities in these areas. As the demand for multi-family housing continues to rise, RIST is positioning itself to take advantage of this trend.

Conversely, the pension fund is adopting a cautious approach towards office spaces, maintaining conservative exposure due to increasing vacancy rates. This decision reflects a broader industry concern regarding the future of office real estate in a post-pandemic world, where remote work has changed the dynamics of workspace needs.

By strategically reallocating its investments, RIST aims to optimize its real estate portfolio, ensuring a balanced approach that mitigates risks while targeting growth in sectors poised for recovery and expansion. The fund's proactive stance highlights its commitment to adapting to evolving market conditions.

MORE NEWS

February 22, 2026 - 08:25

OT Real Estate Spotlight of the Week: 2942 Trails WayThis week`s featured property is a charming and expansive residence located at 2942 Trails Way, offering ample space for family living and entertaining. The home presents a welcoming brick and...

February 21, 2026 - 18:11

Chicago sues after Suzie B. Wilson real estate auction failsThe City of Chicago has initiated legal action against the firm it hired to auction off city-owned properties, following the complete collapse of the sales event. The lawsuit centers on a failed...

February 21, 2026 - 05:37

Veteran Home Buyers Accuse Mortgage Lender of Steering, False Affiliation With VAA new lawsuit filed by three military veterans accuses one of the nation`s largest VA loan specialists of predatory behavior and deceptive marketing. The plaintiffs claim Veterans United Home Loans...

February 20, 2026 - 13:48

Central Florida's slow real estate market may be building momentumAfter a prolonged period of cooling sales and rising inventory, the Central Florida housing market is displaying encouraging signs of gathering strength. Realtors across the region report a...