Surge of Retired Sellers in the DMV Boosts Home Listings

June 24, 2025 - 19:59

This spring, the Washington D.C. metropolitan area, commonly referred to as the DMV, experienced a notable increase in home listings attributed to a rise in retired sellers. This trend stands in contrast to the broader mid-Atlantic region, where the number of retirees entering the housing market has not seen the same level of activity.

As many federal employees reach retirement age, they are choosing to sell their homes, contributing to a more dynamic real estate market in the area. This influx of listings is creating new opportunities for potential buyers, who are navigating a landscape that has been characterized by limited inventory in recent years.

The increase in home availability comes at a time when many retirees are looking to downsize or relocate, further impacting the housing market. This shift has the potential to reshape the dynamics of the local real estate scene, offering fresh prospects for both sellers and buyers alike.

MORE NEWS

March 3, 2026 - 11:42

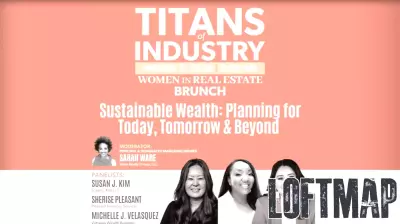

Women in Real Estate Brunch this week in ChicagoThe Windy City is set to welcome a significant gathering of professionals this week with the inaugural Women in Real Estate Brunch. The event, designed to foster connection and collaboration, will...

March 2, 2026 - 20:37

Lawmakers to make real estate wholesalers disclose business modelsA new legislative effort is taking direct aim at the practices of real estate wholesalers, mandating greater transparency in their business models. The proposed law seeks to protect vulnerable...

March 2, 2026 - 00:12

Real Estate Agent Reveals Overlooked Thing That Turn Buyers off Your HomeA seasoned real estate professional has highlighted a surprisingly common yet frequently missed flaw that can derail a home sale. According to the agent, this particular issue is something sellers...

March 1, 2026 - 03:28

Hey, real estate brokers: AI is not ‘coming soon,’ it’s already hereThe commercial real estate industry is no longer waiting on the horizon for artificial intelligence; it is actively operating in the here and now. From automating property valuations and generating...